Why

Having access to everyday financial products and services, such a day-to-day transaction account is an essential part of being independent and being able to participate fully in the community. However, existing research has found that there are low rates of banking service usage among young Autistic youth, which indicates low levels of financial independence. Research also shows that autistic youth feel concerned about their lack of financial management skills and saw this as a barrier to achieving independence. Other factors that may influence financial independence include employment situation, income level, experiences of financial exploitations or scams, and having a mental health condition.

One practical way to improve people’s financial independence is to improve the products and services provided by banks and financial institutions. So, finding out what banks and financial institutions can do to help make their products and services more accessible is an important step towards further inclusivity and financial independence for Autistic people.

What are the barriers to and enablers of financial services usage for adults on the spectrum? What can banks and financial institutions do to ensure their products and services are autism-friendly?

The research

The aim of this research was to gain a better understanding of the financial and banking experiences of Autistic adults. Topics that this study examined included:

- What is the reported financial wellbeing of a sample of Autistic adults living in Australia?

- What types of financial services are used by Autistic adults living in Australia?

- What makes it easier and what makes it more difficult for Autistic adults living in Australia to access financial services?

- How satisfied are Autistic adults living in Australia with the services provided by financial and banking institutions?

- What constitutes an autism-friendly banking experience?

What we learnt

We interviewed a sample of Autistic adults and parents/carers of Autistic adults to gain a detailed understanding of the financial and banking experiences of Autistic adults living in Australia.

Study participants

45 Autistic adults

- 47% female

- 13% male

- 18% other gender

23 parents/carers

82% female

18% male

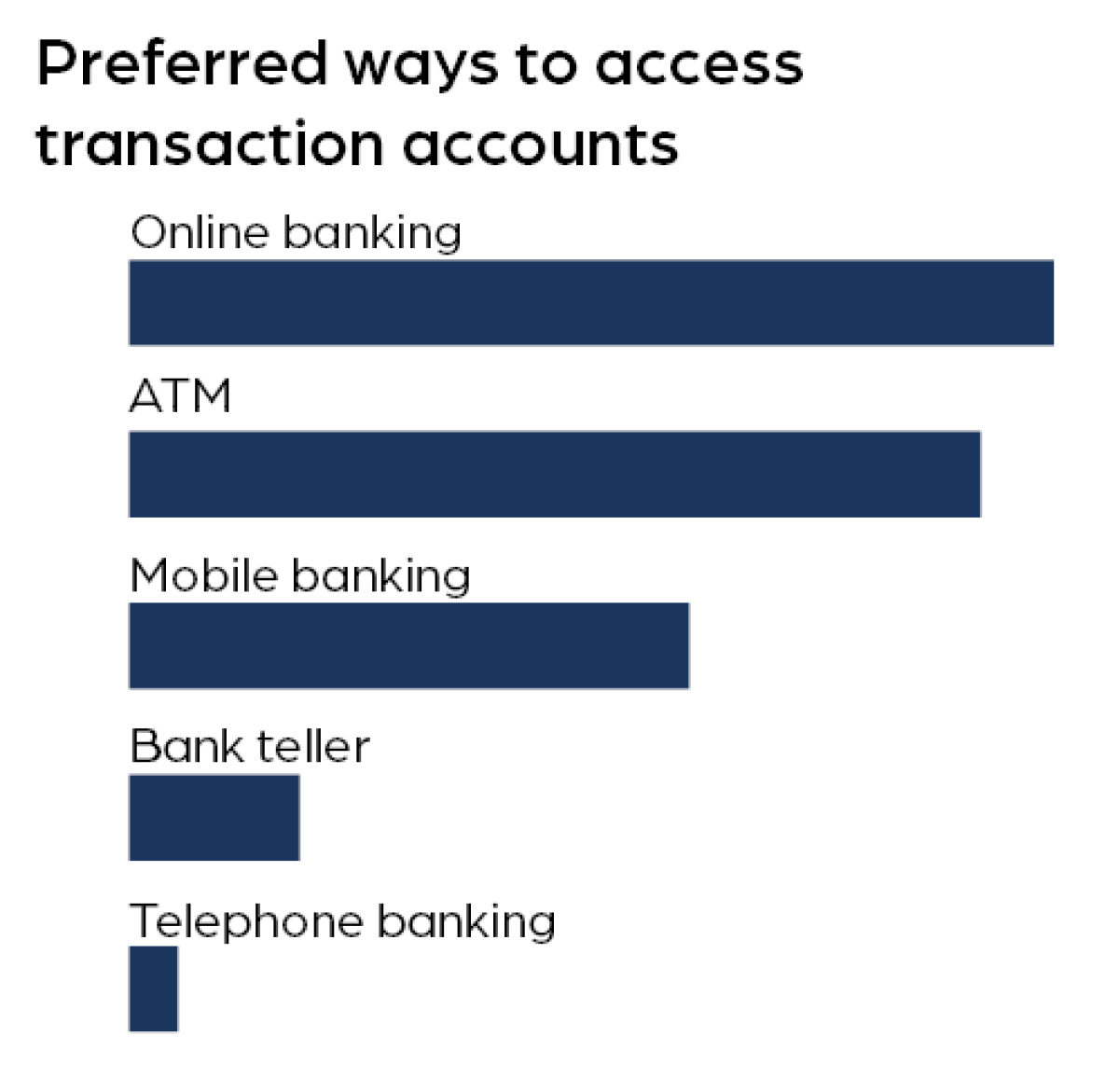

Use of financial products and services

Satisfaction with banking services

31% of Autistic adults were satisfied with their current level of financial independence.

27% of Autistic adults wanted to be more financially independent.

47% of Autistic adults had contacted a bank or financial institution in the past 12 months:

- Individuals were most satisfied with branch access.

- Individuals were least satisfied with phone access.

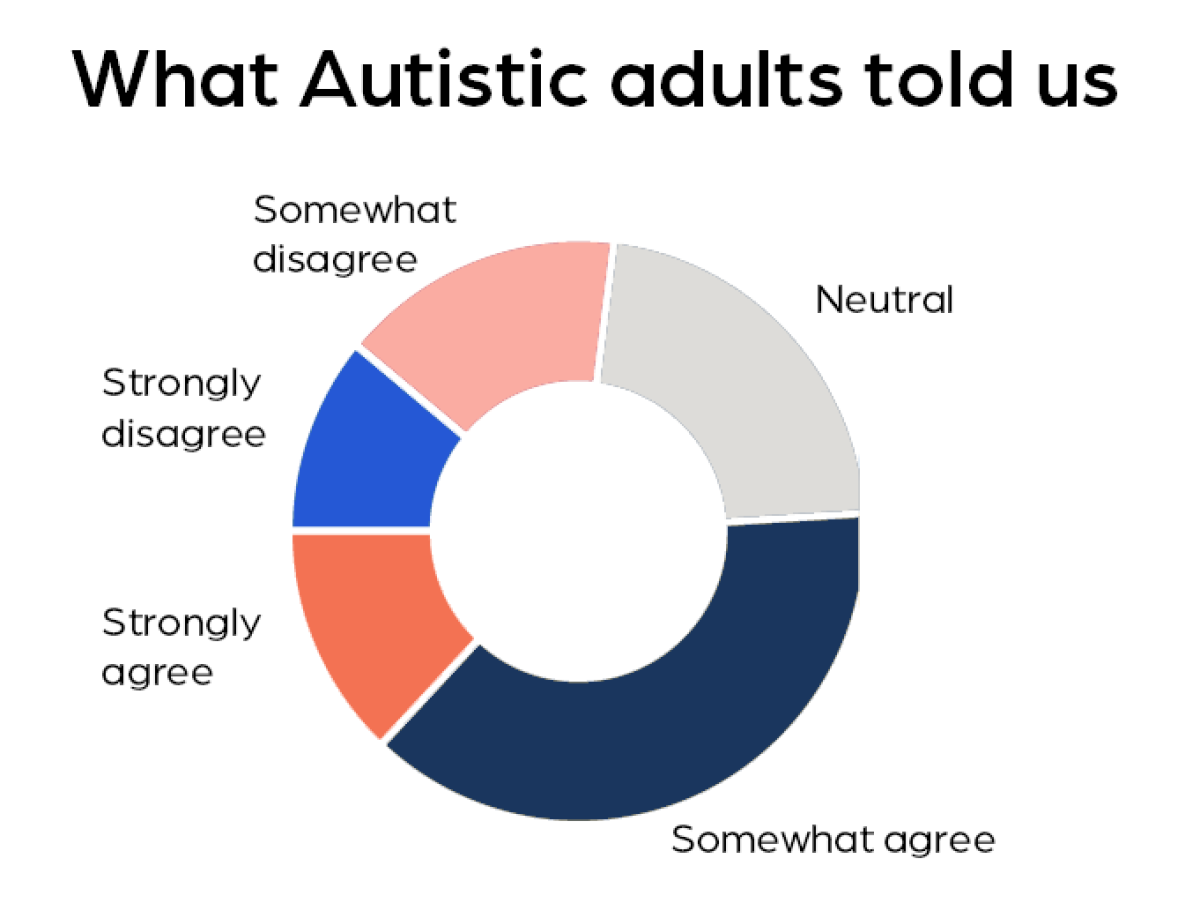

Are the banking needs of Autistic adults’ being met by banks and other financial institutions?

Ways in which banks are not meeting needs as described by Autistic adults:

- A lack of understanding from bank staff of autism and associated life circumstances

- Difficulties with going into a branch and having face-to-face contact

- Information not accessible in Easy English or Auslan

- Issues with phone banking

- Inaccessibility due to requiring voice-access

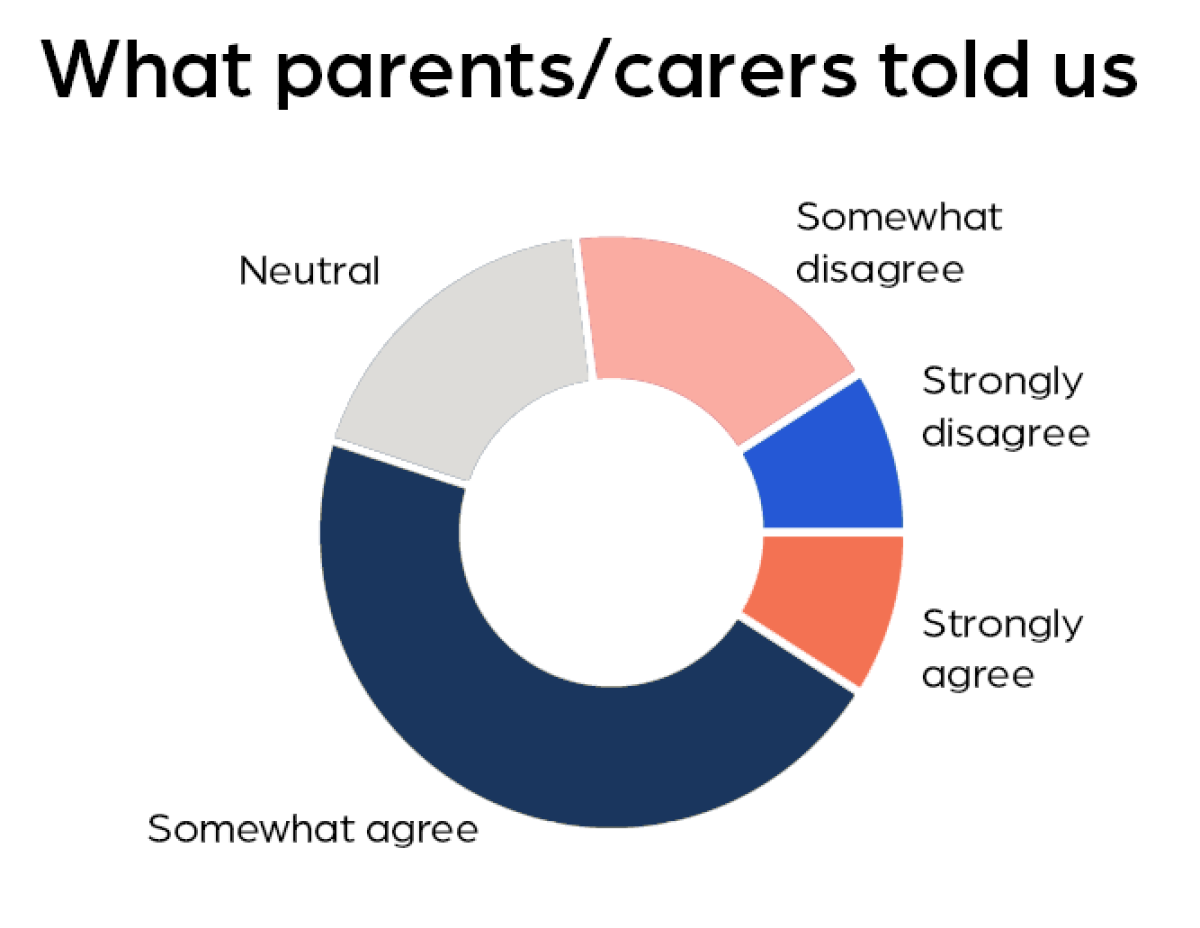

Reasons needs are not being met as described by parents/carers:

- No provision of products or services for people with special needs

- Being offered products or services not beneficial or suitable for their children e.g. offering high limit credit cards

- Insistence on speaking to adult children when it is not feasible (i.e. their adult child is non-verbal or minimally verbal)

- No mechanisms for parents to support adult children in managing bank accounts

Desire for greater support

- 78% of Autistic adults and 74% of parents responded ‘yes’ when asked if banks could do anything differently to support Autistic people.

- 42% of Autistic adults indicated they would like more support to manage finances.

Recommendations

- Increase staff awareness of autism

- Introduce more inclusive products and services e.g. introduce autism champions, modify bank branches to be more autism friendly, establish processes to enable parental support.

Find out more

Publication

Cai, R.Y., Love, A., Haas, K., Gallagher, E. and Gibbs, V. (2024). Understanding banking experiences of autistic adults: an inquiry into inclusive banking. Advances in Autism.

Making a difference

The findings of this research will help banks and other financial institutions to create a more inclusive customer experience for Autistic people.

The findings of this research will be used to inform the design and development of financial support programs. Recommendations will also be made to help banks and other financial institutions to create a more inclusive customer experience for autistic people.

Aspect research team

Ru Ying Cai, Aspect Research Centre for Autism Practice (ARCAP)

Vicki Gibbs, ARCAP

Kaaren Haas, ARCAP

Emma Gallagher, Autism Consultant Research and Practice, ARCAP

Started

July 2019

Ends

2020

Funding

Beyond Bank Australia